Roi calculation example

As a performance measure ROI is used to evaluate the efficiency of an investment or to compare the efficiencies of several. Therefore the project value is.

Return On Investment Roi Formula And Excel Calculator

Return on investment ROI measures how effectively a business uses its capital to generate profit.

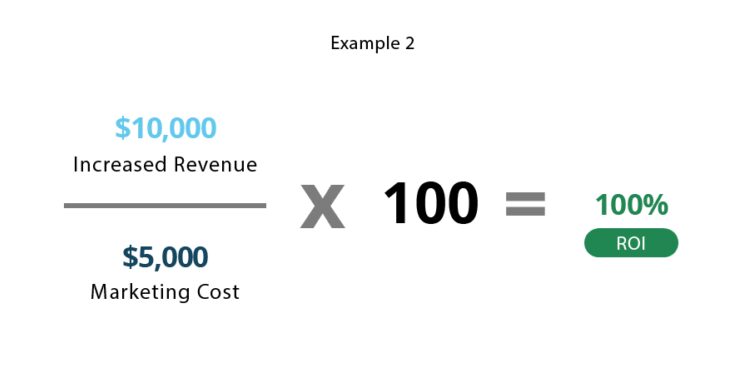

. A marketing manager can use the property calculation explained in the example section without accounting for additional costs such as maintenance costs property taxes sales fees stamp duties and legal costs. For example if an investment generates annual returns of 5000 and the cost of the investment is 100000 the ROI would be 5. For example Ill pay 100 to make 600 but I wont pay 3000 to make a 1000 profit.

Heres an example of how a company might measure ROI of email marketing. If the profit and ROI makes sense then I look at prepping. You can use one or more of four ROI calculation methods.

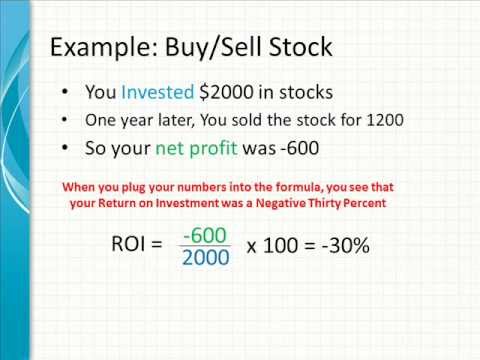

Consider leveraging measurements like brand awareness strategy surveys social. A performance measure used to evaluate the efficiency of an investment or to compare the efficiency of a number of different investments. A negative ROI means that your investment was greater than the value it generated aka.

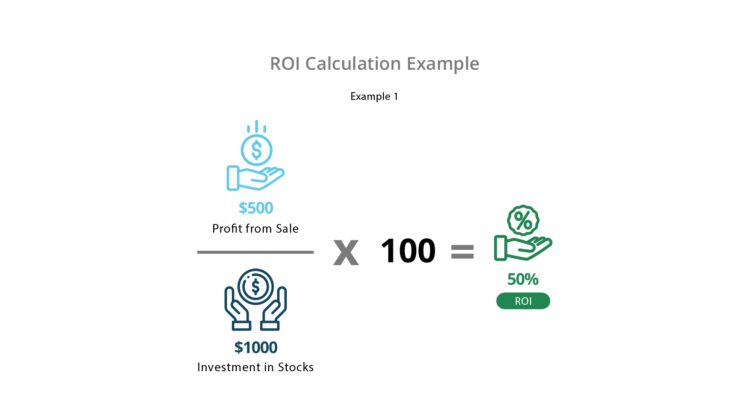

The ROI for this investment is 50 300 - 200 200 100. Here we discuss the ROI Formula and its calculation including an example interpretation benefits and limitations. They then calculated the project values by reducing the cycle time.

Then ROI is my next factor and Ill consider a product even if the profit is under 1000 or I may not buy it even if it will give me a 1000 profit. To better understand this formula consider a few examples. Let us take an example of a stock with a beta of 175 ie it is riskier than the overall market.

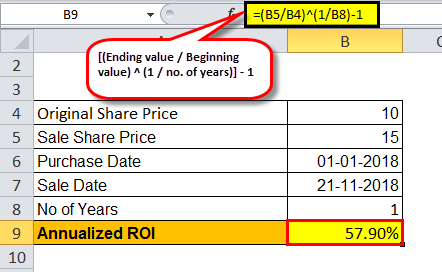

From the beginning until the present he invested a total of 50000 into the project and his total profits to date sum up to 70000. Further the US treasury bonds short-term return stood at 25 while the benchmark index is characterized by a long-term average return of 8. If for example commissions were split there is an alternative method of calculating this hypothetical investors ROI for the Worldwide Wickets Co.

If the investor made total mortgage payments principalinterest of 2000 a month in this scenario then the Cash-on-Cash investment would be as follows. The basic ROI calculation cannot help you determine which investment was best. 6 to 30 characters long.

For example suppose an investment was initially made at 200 and is now worth 300. Lets say you invested 5000 in the company XYZ last year for example and sold your shares for 5500 this week. 20 x 2 x 10.

Same rental property can generate two different returns depending on the investor. Also does an ROI calculation involve every cash flow in the middle other than the first and the last. An organic dog food company pays them 100 to place an ad that links to a purchasing page for their newest product.

In this case the net profit of the investment current value - cost would be 500 1500 - 1000 and the return on investment would be. The process below empowers you to capture and express a quantified value for change managements contribution. For example accountants use appreciation to find the positive adjustment of the initial value of an asset and real estate agents use depreciation to find the decrease in a propertys value due to deterioration.

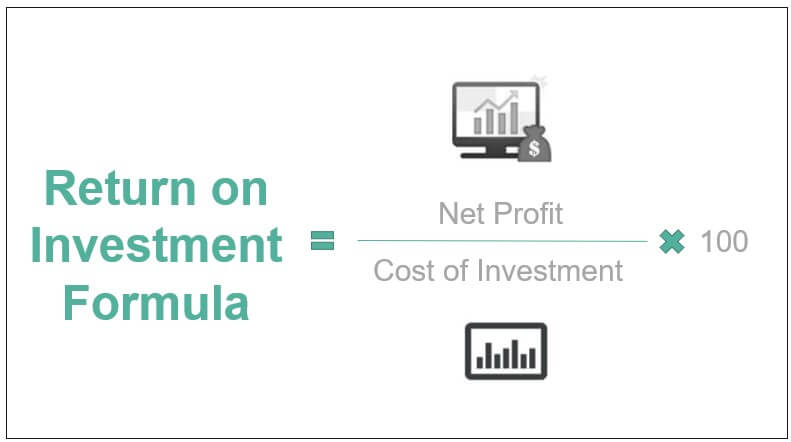

ASCII characters only characters found on a standard US keyboard. Hire three IT network developers or Implement a talent exchange program in the marketing department or Achieve an Employee Net Promoter Score of 20. Return on investment ROI or return on costs ROC is a ratio between net income over a period and investment costs resulting from an investment of some resources at a point in time.

The higher the ROI the better. The ROI of change management is the additional value created by a project due to employee adoption and usage. As a most basic example Bob wants to calculate the ROI on his sheep farming operation.

These numbers have been used for other investment evaluation approaches as well refer to our cost-benefit analysis overview to learn more details as well as the results of other methods. ROI measures the amount of. ROI is arguably the most popular metric to use when comparing the attractiveness of one IT investment to another.

A midsize manufacturing company wants to know whether to invest in a new 10 million facility. Calculate the required rate of return of the stock based on the given information. How To Perform Calculation of Future Value With Examples.

Value achieved investment made investment made X 100 social media ROI. An Alternative ROI Calculation. Heres a simple formula for how to calculate ROI for social media.

A high ROI means the investments gains compare favourably to its cost. Return On Investment - ROI. To calculate the percentage ROI for a cash purchase take.

You may learn more about Financial Analysis from the following articles High-Low Method High-Low Method The high-low method is used to separate fixed and variable cost elements from the historical cost mixture of fixed and. In this example the project team calculated a single unit. Must contain at least 4 different symbols.

Lets look at an example. A local dog daycare offers a weekly e-newsletter to customers and those who sign up on their website. For example marketers tracking publicly available financial data can estimate the ROI of competitors and adjust baselines to reflect these estimateshelping to keep efforts consistently competitive.

Lets use this formula in a few examples of human capital ROI calculation. 1178400 1125360. Example 2 Use of Single- and Multi-Period ROI to Compare Project Options In this example three project options are compared with each other.

How to Calculate ROI. Analyze ROI with an Eye Toward Change Management. The outcome of an ROI calculation will vary.

To begin lets define return on investment ROI. And subsequently applied to marketing ROI calculation. Suppose you roll out a health and wellness initiative in the workplace costing.

An ROI calculation will differ between two people depending on what ROI formula is used in the calculation. Simple Calculation - The ROI formula only requires a few inputs. Return on Investment Example 1.

To illustrate lets look at the ROI calculation for the same single-family rental property acquired with and without financing. As long as your ROI is more than 0 your investments are making your business money. Because the calculation is based solely on before-tax cash flow relative to the amount of cash invested it cannot take into.

An investor buys 1000 worth of stocks and sells them 1 year later when their value reaches 1500. The first is a project that will reduce process cycle-time of a particular product by 10 percent. Return on investment ROI measures how much money or profit is made on an investment as a percentage of the cost of that investment.

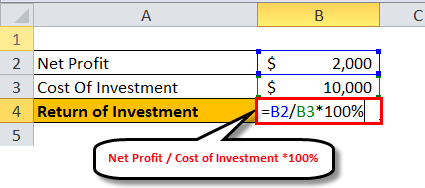

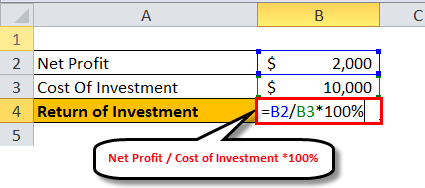

Calculating Return On Investment Roi In Excel

Return On Investment Definition Formula Roi Calculation

How To Calculate Roi Youtube

Return On Investment Roi Definition Equation How To Calculate It

5 Easy Ways To Measure The Roi Of Training

Return On Investment Definition Formula Roi Calculation

Return On Investment Roi Formula And Excel Calculator

How Do You Use The Roi Formula On Excel Monday Com Blog

Calculating Return On Investment Roi In Excel

5 Easy Ways To Measure The Roi Of Training

Return On Investment Roi Formula Meaning Investinganswers

Return On Investment Roi Formula Meaning Investinganswers

Return On Investment Definition Formula Roi Calculation

.jpg)

Return On Investment Roi Formula Meaning Investinganswers

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube

Return On Investment Roi Formula And Excel Calculator

Calculating Return On Investment Roi In Excel